Compliance Declaration

The Compliance Declaration (the declaration) is a new voluntary form that mineral licence applicants will be asked to complete as part of the minerals licensing application process. It has been added to the Tenement Application and Variations application forms in the Resource Rights Allocation and Management (RRAM) portal and allows applicants to declare compliance matters upfront.

Purpose of the compliance declaration

By completing the declaration, this will assist the Resources Victoria to determine eligibility for fast-track processing based on past performance. Applicants who don’t complete the declaration will not be eligible for fast-track processing.

Who needs to complete the declaration

Anyone with existing operations in Victoria may complete the declaration when submitting an application. This includes applications for a new licence or applications relating to an existing licence, such as renewals and transfers (under Variations in RRAM). New entrants will not be eligible for fast-tracking an application since there is no past performance in Victoria.

How will Resources Victoria use information declared

Where you answer ‘no’ this confirms you have nothing to declare and will enable Resources Victoria to fast-track processing of your application. Where you declare ‘yes’ to any question, this will assist Resources Victoria to triage your application and focus our assessment on relevant matters. All information is collected and stored in accordance with existing data protection and privacy laws.

Consequences of false or misleading information

It is important to note that providing false, misleading or omission of relevant information in the declaration is an offence under the Mineral Resources (Sustainable Development) 1990 Act. Resources Victoria may take action depending on the circumstances of the application. Consequences for false information may include;

- notice of intention to cancel a licence

- requiring the licensee to enter into an enforceable undertaking

- issuing a notice to the licensee requiring specified action.

Auditing and enforcement of compliance declarations

Resources Victoria will undertake periodic audits of Compliance Declarations against our records. If any false or misleading information is found, the appropriate enforcement actions will be taken to prevent future offences.

Historical non-compliance and its impact

Depending on the type of non-compliance, historical non-compliances may be attached to individuals or companies. Historical performance specific to a licence is attached to a company. Any Fit and Proper Person information is attached to an individual/s (e.g. company directors). The compliance declaration takes both into consideration.

Earning back 'good performance' status

All non-compliance matters are considered in context to the application and current performance. This includes applications for different mineral types.

Operators have the opportunity to earn back a ‘good performance’ status over time. Where a company has made efforts to remedy the issue, this will reflect positively. Companies that have repeated infractions or have made no efforts to rectify former non-compliance issues will not be considered for fast-tracking.

How to check outstanding invoices and reports in RRAM

Checking for outstanding invoices

Outstanding invoices can be seen by reviewing financial transaction records on each tenement.

Follow the below steps to check the status of your invoices.

- Click the “Financial Transactions” section on each tenement record.

- Each financial transaction record will have a “Payment Status” field. This section will display information such as “Draft,” “Ready for Payment,” “Invoiced,” and “Payment Cleared.”

- If the status is “Invoiced,” an invoice has been delivered but payment to the department has not been made. You will be required to submit payment to the department.

- If the status is “Payment Cleared,” our Oracle system has payment in full recorded for that specific financial transaction. No further action is required.

Checking for outstanding reports

To check for outstanding reports, navigate to the ‘Tenement Record’ section in the RRAM portal.

Each tenement record will have a series of date fields for reporting.

The example below shows reporting date fields near the top of the record on the right side. You must review reporting dates on each tenement record.

If the reporting dates are in the past, they have outstanding reports to submit.

You can also review the list of legislative reports in the “Legislative Reports” section further down the page on the tenement record. All reports with their reporting years can be reviewed in this section.

Screenshots of process in RRAM

Follow steps 1-5 below for navigating the RRAM Portal to see reporting dates, financial transactions and invoices.

Step 1

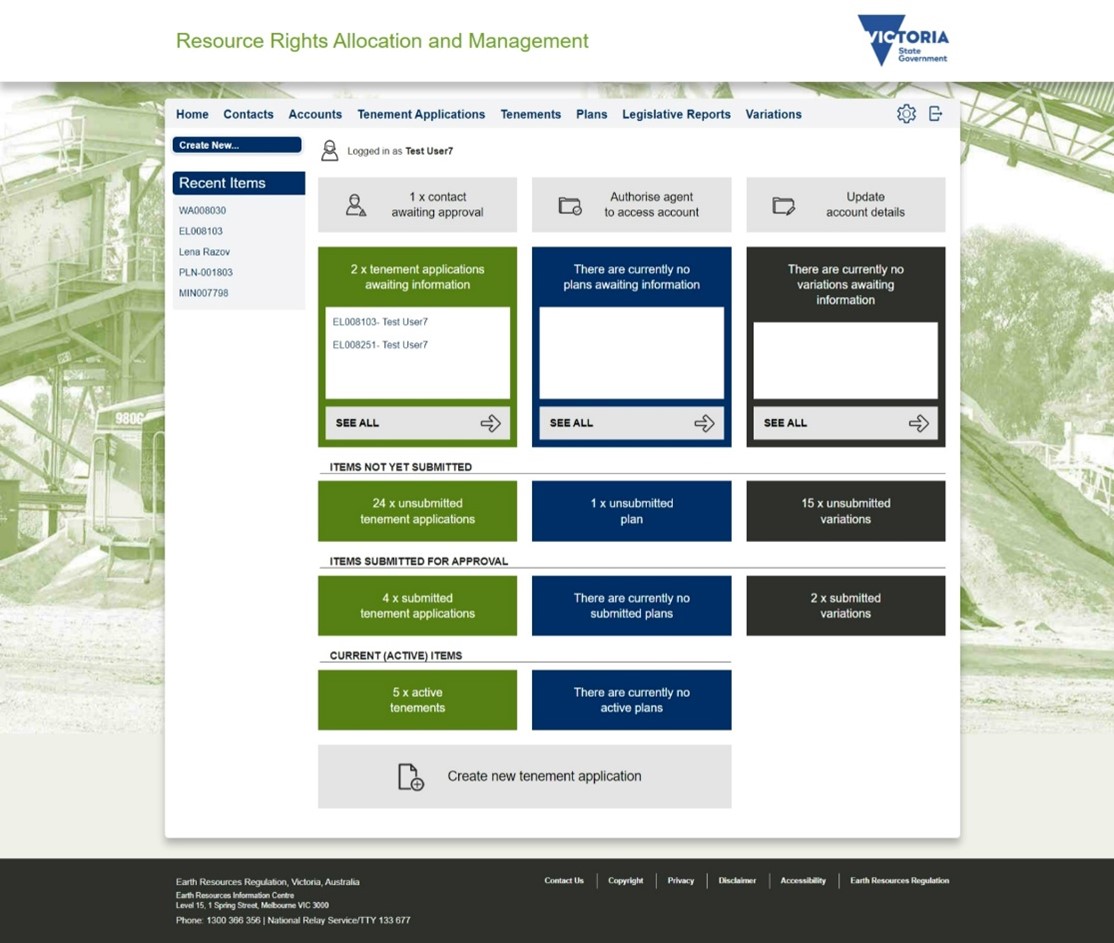

This is what you will see when you first log into the RRAM Portal.

Step 2

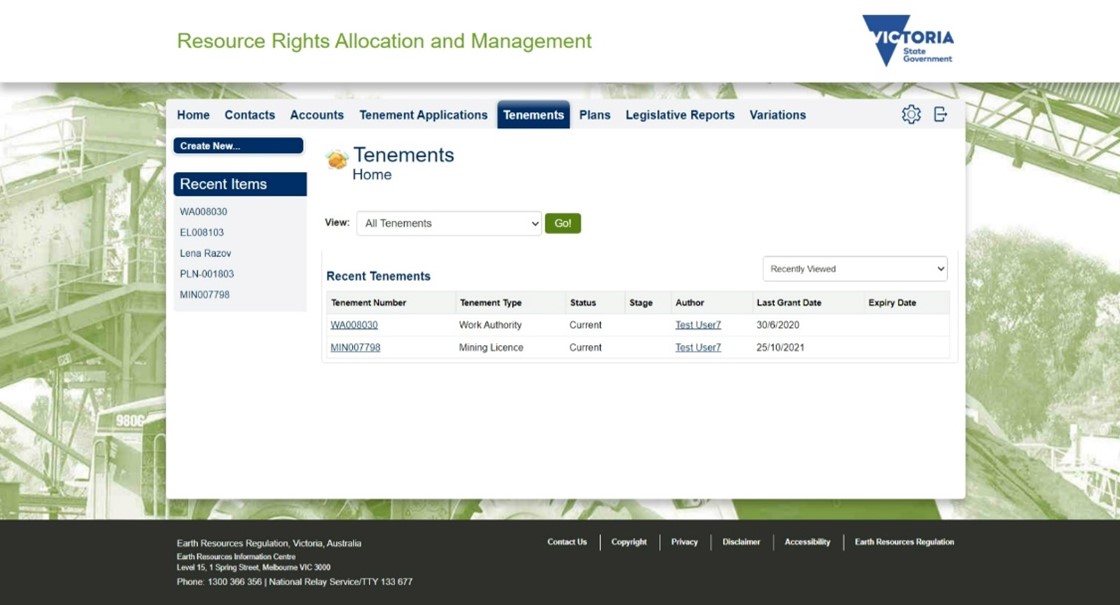

By clicking the “Tenements” tab at the top, you can review the tenements associated with your account. You can then select a tenement to review its details.

You can navigate to the tenements tab and then a specific tenement. A tenement record includes workplans, variations, financial transactions, etc

Step 3

On the tenement record, you can see reporting dates near the upper portion of the page. You can scroll down the page to the “Financial Transactions” section to review associated financial transaction records for the tenement. Click the transaction record to review its details and access the PDF invoice.

Step 4

On the financial transaction record, you can review and also download the associated invoice by clicking the “View” link. The PDF will then automatically download onto your computer.

Step 5

With the invoice downloaded onto the computer, you can review and take payment actions where necessary. The invoice will provide guidance on how to pay.

Contact information

If you need support submitting the application through the RRAM portal, please contact RRAM.support@deeca.vic.gov.au.

If you need any further information on the licensing process, please contact licensing.err@deeca.vic.gov.au.

Page last updated: 13 Feb 2026